Blogs

Blogs

21 Nov, 2022

There’s no denying the housing market is undergoing a shift this season, and that may leave you with some questions about whether it still makes sense to sell your house . Here are three of the top questions you may be asking – and the data that helps answer them – so you can make a confident decision. 1. Should I Wait To Sell? Even though the supply of homes for sale has increased in 2022, inventory is still low overall. That means it’s still a sellers’ market. The graph below helps put the inventory growth into perspective. Using data from the National Association of Realtors (NAR), it shows just how far off we are from flipping to a buyers’ market:

25 Oct, 2022

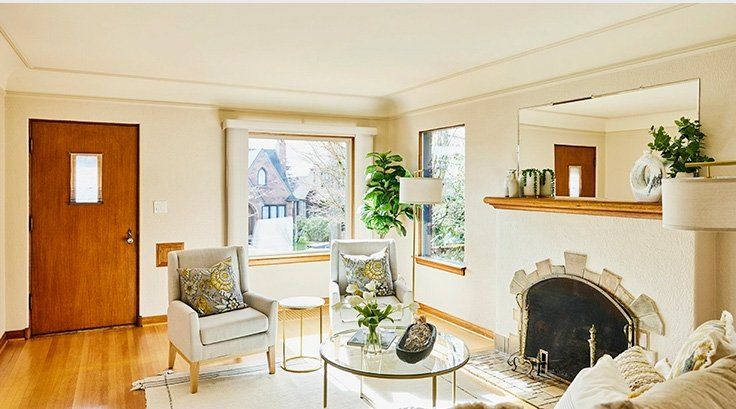

With higher mortgage rates , you might be wondering if now’s the best time to buy a home. While the financial aspects are important to consider, there are also powerful non-financial reasons it may make sense to make a move. Here are just a few of the benefits that come with homeownership. Homeowners Can Make Their Home Truly Their Own Owning your home gives you a significant sense of accomplishment because it’s a space you can customize to your heart’s desire. That can bring you added happiness. In fact, a report from the National Association of Realtors (NAR) shows making updates or remodeling your home can help you feel more at ease and comfortable in your living space. NAR measures this with a Joy Score that indicates how much happiness specific home upgrades bring. According to NAR: “ There were numerous interior projects that received a perfect Joy Score of 10 : paint entire interior of home, paint one room of home, add a new home office, hardwood flooring refinish, new wood flooring, closet renovation, insulation upgrade, and attic conversion to living area.” And as a homeowner, unless there are specific homeowner’s association requirements, you typically won’t have to worry about the changes you can and can’t make. If you rent , you may not have the same freedom. And if you do make changes as a renter, there’s a good chance you’ll need to revert them back at the end of your lease based on your rental agreement. That can add additional costs when you move out. The Responsibilities of Homeownership Give You a Greater Sense of Achievement There’s no denying taking care of your home is a large responsibility, but it’s one you’ll take pride in as a homeowner. Freddie Mac explains : “As the homeowner, you have the freedom to adopt a pet, paint the walls any color you choose, renovate your kitchen, and more. . . . Of course, along with the freedoms of homeownership come responsibilities, such as making your monthly mortgage payments on time and maintaining your home. But as the property owner, you’ll be caring for your own investment. ” You’re not taking care of a living space that belongs to someone else. The space is yours. As an added benefit, you may get a return on investment for any upgrades or repairs you make. Homeownership Can Lead to Greater Community Engagement That sense of ownership and your feelings of responsibility can even extend beyond the walls of your home. Your home also gives you a stake in your community. Because the average homeowner stays in their home for longer than just a few years, that can lead to having a stronger connection to your local mid-Missouri community. NAR notes how that can benefit you: “Living in one place for a longer amount of time creates an obvious sense of community pride, which may lead to more investment in said community.” If you’re looking to put down roots, homeownership can help fuel a sense of connection to the area and those around you. Bottom Line If you’re planning to buy a home this year, there are incredible benefits waiting for you at the end of your journey , including the ability to customize your home, the sense of achievement homeownership brings, and a greater connection to your community. Connect with Tori Messenger and her team in Columbia, MO to discuss everything homeownership has to offer.

05 Oct, 2022

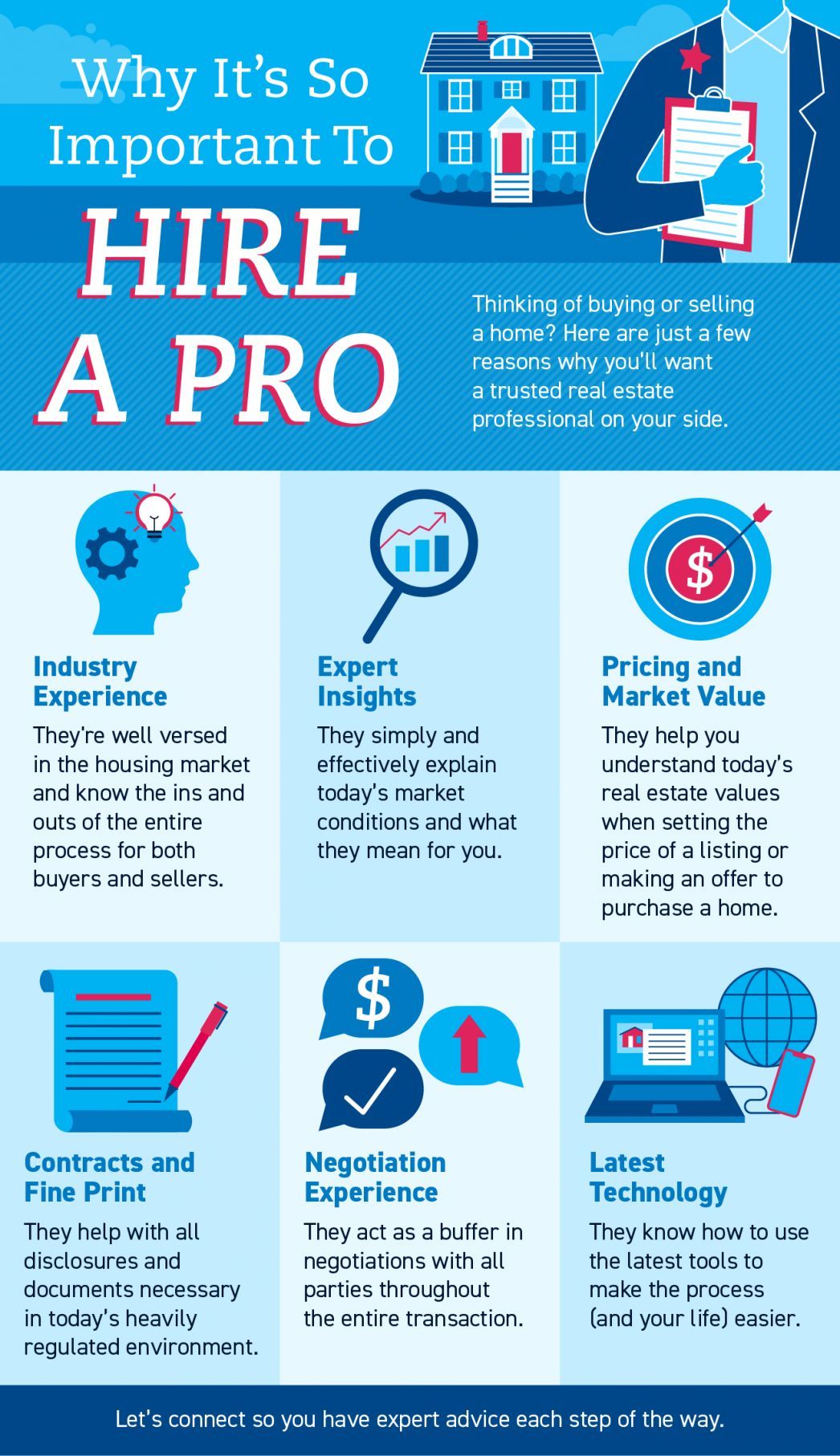

Some Highlights If you’re thinking of buying or selling a home, you’ll want a trusted real estate professional on your side for their industry experience and expert insights. The right advisor utilizes the latest technology and can help you navigate today’s home pricing and market values, the contracts and fine print, and the negotiations you’ll face. Let’s connect so you have expert advice each step of the way.

05 Oct, 2022

Experts are starting to make their 2023 home price forecasts. As they do, most agree homes will continue to gain value, just at a slower pace. Over the past couple of years, home prices have risen at an unsustainable rate, leaving many to wonder how long it would last. If you’re asking yourself: what’s ahead for the price of my home, know that experts are now answering this question, and its welcome news for homeowners who may have been led by the media to believe their home would lose value. Historically, home prices have appreciated at a rate near 4% . For 2023, the average of six major forecasters noted below is 2.5%. While one, Zelman & Associates , is calling for depreciation, the other five are calling for appreciation. The graph below outlines each expert forecast to show where they project home prices are going in the coming year.

05 Oct, 2022

While watching the stock market recently may have started to feel pretty challenging, checking the value of your home should come as welcome relief in this volatile time. If you’re a homeowner, your net worth got a big boost over the past few years thanks to rising home prices. And that increase in your wealth came in the form of home equity. Here’s how it works. Equity is the current value of your home minus what you owe on the loan. Because there was a significant imbalance between the number of homes available for sale and the number of buyers looking to make a purchase over the past few years, home prices appreciated substantially. And while rising inventory and mortgage rates have cooled the market some in recent months, home prices nationally remain strong. That’s why, according to the latest Homeowner Equity Insights from CoreLogic , t he average homeowner equity has grown by $60,000 over the last 12 months. While that’s the national number, if you want to know what happened, on average, over the past year in your area, look at the map below from CoreLogic :